The technology that could shape Canada’s energy future started with a clock some 146 years ago.

The technology that could shape Canada’s energy future started with a clock some 146 years ago.

During the second industrial revolution, in 1877, Austrian engineer Carl Albert Mayrhofer designed a compressed air system that emitted a pulse of air every minute to power a network of clocks around Vienna. Within the decade, harnessing the kinetic energy of compressed air went from a relatively novel concept to an 18,000 kW compressor system — as it did in a Parisian power plant designed by Mayrhofer’s apprentice, Viktor Popp, in 1888.

Of course, this was an era of change and uncertainty, where governments and industry magnates took gambles on innovation. It wasn’t yet written in the sky that fossil fuels would come to dominate the energy sector, now how widespread electrical power use would become.

But the development of compressed air energy storage (CAES) — and energy storage more broadly — would be hampered by cost accessibility of coal and gas for thermal firing plants, and an absence of published works to reflect the impacts of coal and gas. Entire communities in the United States formed around coal mines and, across the world, crude oil replaced gold as the most sought after commodity. Though air compressors continued to evolve in the industrial sector — powering tools, vehicles and cooling systems across the world — it would take an international energy crisis to breathe life into their use in large scale energy storage.

When the price of oil skyrocketed during the OPEC crisis of the 1970s, Germany and the United States began investing in CAES.

“The crisis demonstrated that, without innovation and self-sufficiency, your entire economy could be held hostage by oil and gas producing countries,” said Evan Tummillo, Director of External at Bedrock Energy Corp. “The early research showed that by using excess energy and storing it in giant caverns of compressed air, a power plant could dramatically increase its output.”

In Germany, CAES was a crucial part of the 190 megawatt Huntorf power plant, which opened in 1978 and remains operational. In Alabama, research that began during the OPEC crisis led to the commissioning of a 110 megawatt plant opened in 1991. The facility uses CAES to capture more than 50 per cent of the energy that would normally be lost during production.

But the spirit of innovation that fueled the rise of these plants died when the OPEC crisis ended in the late 1970s.

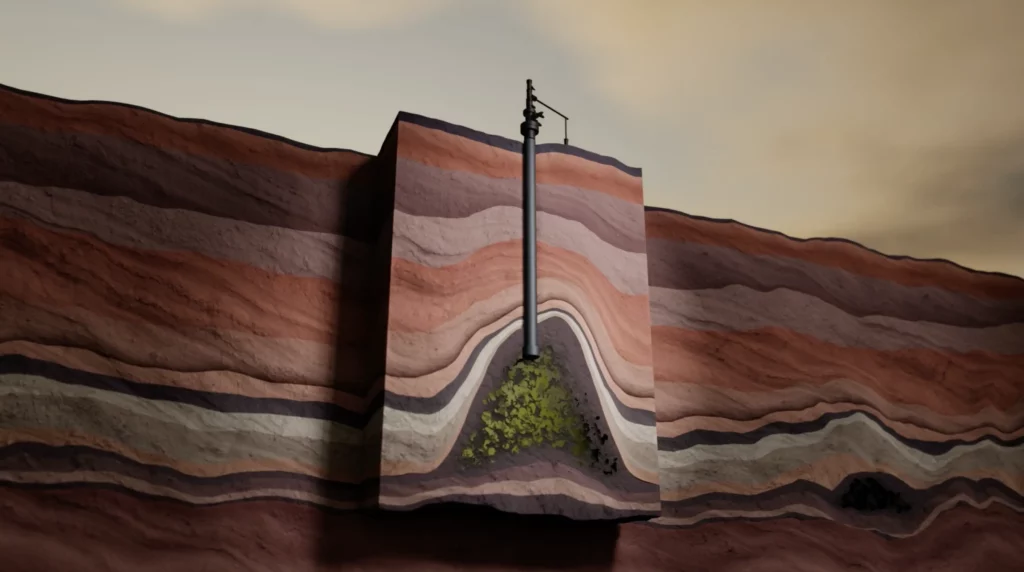

Natural gas extraction of Bayfield reservoir in the 1950’s (video still from Ontario’s Unique Geology And Why It Makes CAES Possible).

“There was a lot of potential that was lost when the OPEC crisis ended and everyone just leaned back on oil and gas,” Tummillo said. “As governments were investing in CAES, they were also investing in alternative energy sources like nuclear fusion and electric cars. But that was all pushed aside because fossil fuels were easy and cheap. There was no motivation for governments to invest in research. Until now.”

With climate change threatening to do irreversible damage to the planet, the world’s largest economies are transitioning towards net-zero greenhouse gas emissions in the production of electricity. And some of the biggest players see CAES as an essential part of that equation.

The Chinese government invested the equivalent of $300 million USD last year to start construction on a 350 megawatt plant in Shandong province. Also last year, Goldman and Sachs — an investment bank that manages $2 trillion in assets — made a $250 million bet on CAES, funding plants in California and Australia.

What makes CAES such an attractive investment, Tummillo says, is its ability to store excess energy during off-peak hours and feed it back into the grid when system needs ramp up. That allows for clean energy technology like solar and wind power — which are inconsistent at the best of times — to continually generate power without adding greenhouse gas into the atmosphere.

“In China, there’s been a realization that hydroelectric dams are prohibitive in terms of geography — you need massive rivers — and they have vast amounts of money to invest in the future of energy,” Tummillo says. “That they’re choosing to go big on power storage tells us a lot. Right now, if a bank has the choice to one of two projects — one that uses all established technology and another that’s based on giving a blank cheque to an engineer and tell him “figure it out” — they’re going to chose the established method every time.

“But we’re in a global warming crisis, a global energy crisis and we got here using that sort of thinking. It’s time to innovate and be bold. And that’s where I believe Bedrock shines as a comfortable middleground, blending established technologies into a solution tailormade for our time.”